Unlocking the Power of Cash Value in Life Insurance: 5 Strategic Uses

From retirement planning to real estate investing—use your life insurance to build wealth and secure your future.

When it comes to online financial advice, the internet is rife with aspiring influencers hoping to make a name for themselves by coming up with catchy slogans around one-size-fits-all or overly simplified financial strategies. One of those financial strategies is leveraging the cash value of a permanent life insurance policy by borrowing against it to invest in other opportunities—popularly known as infinite banking. We refrain from calling it infinite banking because “infinite” can be misleading and can create false expectations. We prefer the nomenclature “Family Bank” because, when used properly, it can act as a bank that offer income tax-free loans and help build generational wealth. This is one of the most powerful assets because the cash value in the policy continues to grow when you borrow against it—as long as it’s a non-direct recognition policy. The best aspect of the cash value in a permanent life insurance policy is that it is versatile and can be leveraged to accomplish multiple goals.

Before we dive into the potential ways to maximize the cash value in your policy, let’s first begin by understanding what it is and how it works.

What is cash value life insurance?

Cash value life insurance represents a spectrum of different policy types (i.e. Whole Life, Variable Universal Life, and Indexed Universal Life) that not only provides a death benefit to beneficiaries but also accumulates a cash value over time, accessible in the policyholder’s lifetime if desired. The policyholder benefits from income-tax-free access to the cash value via policy loans at competitive rates, while the cash value continues to grow (so long as it’s a non-direct recognition policy as mentioned above). The death benefit is also inherited income tax free, and if there is any part of the loan that remains unpaid, it comes out of the death benefit paid out. For somebody unfamiliar with the concept, the easiest way to simplify the concept is that cash value life insurance combines a long-term savings account with a life insurance policy, making your money work harder to achieve multiple goals.

How does cash value life insurance work?

When you pay your policy premium, the cost of insurance (mortality charges, policy administration fees, etc.) is subtracted and the remaining part goes towards building the cash value of the policy. The cash value acts as a forced savings vehicle that can accumulate capital gains tax-deferred over time, creating a liquidity pool that can be used to make investments and build wealth. Policies can be tailored to maximize cash value growth more quickly. Depending on the policy type and design, the cash value may grow more quickly by tapping into additional risk and enabling more control over where funds are invested (i.e. ETFs, Index Funds, brokerage accounts, etc.). Policyholders are typically able to borrow up to 90% of the value, and often at better terms than the bank. Some policies may have specific riders or terms that allow the cash value to be added to the death benefit, but these are less common and usually require specific arrangements and potentially higher premiums. However, if policyholders fail to manage the policy correctly, they could lose coverage or face tax implications, which is why we prioritize aftercare and provide annual reviews for our clients.

What is the benefit of the cash value in your life insurance policy during your lifetime?

When used appropriately and strategically, the strategy of creating a Family Bank with a cash-value-optimized policy creates a powerful opportunity to build wealth and leave a legacy. We see too many “financial influencers” encourage irresponsible uses of this permanent life insurance feature, especially for those who might not have the income, wealth, or be in the ideal life stage to warrant doing so. While it might make sense for some to leverage the cash value in the more speculative manner that infinity banking proponents suggest, here are five practical ways to leverage the cash value in your lifetime:

Retirement Planning: EY researchers estimate that by 2030, there will be a $240 trillion retirement savings gap and a $160 trillion protection gap. The retirement savings gap only continues to grow, as the efficacy of the 401(k) as a primary retirement vehicle is increasingly questioned. The cash value in a policy can provide supplemental retirement income, specifically a tax-free source of funds that does not impact Social Security benefits and is not restricted by contribution limits like traditional tax deferred accounts.

Emergency Expenses: Accessing the cash value can provide quick funds, without having to liquidate other investments, to cover unexpected expenses such as medical bills—especially with the increasing rate of long-term disability and healthcare. WSJ recently reported how cancer is capsizing Americans’ finances—the result of higher drug prices and rising-out-of-pocket costs creating increasing economic strain. Even health insurance is not always sufficient, as 98% of cancer patients who went into debt to cover their costs were insured at the time debt was incurred. Moreover, health outcomes are worsening, with nearly 70% of 65-year olds will need some form of long-term care in their lifetimes, according to the U.S. Department of Health and Human Services.

Children’s College Fund: For those who want to leverage the cash value for their next generation, there is always the option of using it to cover higher education. Covering rising tuition and other educational expenses for children is becoming a larger burden, especially as wages struggle to keep up with the inflation of higher education. Parents with enough residual income to commit to savings could even take out a policy on each child, soon after they are born, and the cash value in the policy could grow to cover a portion (or the entirety) of that child’s college tuition and extra costs. This can be an alternative to student loans, which often have higher interest rates.

Real Estate Investments: For entrepreneurial real estate developers and those pursuing the expansion of their real estate portfolio, the ability to take out tax-free loans against the cash value of your policy presents a powerful tool for creating more liquidity. Investing in a rental property or other real estate opportunities is one of the most popular ways people maximize the cash value given its ability to generate rental income and potential property value appreciation—helping quickly pay off the loan and start the process all over again.

Starting a Business: The same manner in which the loan against the cash value can be used to invest in real estate, it can also be utilized to fund a new business venture. The cash value can serve as seed money, without the need for a traditional bank loan or outside investor, which might be harder to obtain. Perhaps you only want to work for another five to ten years, until you save enough to quit and take a chance on opening the bakery of your dreams. Or maybe a bakery is too much of a morning-person passion for you, and you are working towards opening a bar in the theme of “Dogs Playing Poker”. Side note: apologies if we just leaked your secret for the world to take; we’d be happy to help you brainstorm another, better one.

Ways to maximize the cash value in your policy

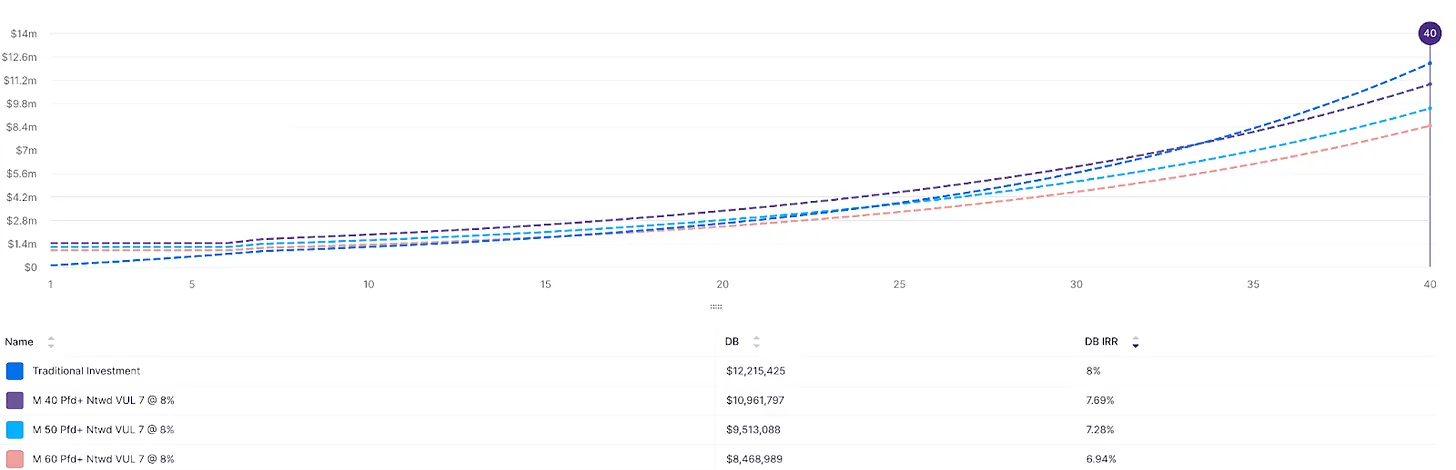

The first way to maximize the cash value is to start early, both because life is unpredictable and you never know when you need it and because insurance costs are lower the younger you are. The only way to ensure you have it when you need it is to acquire it before you do, but if you want to become your own banker, it’s important that you have enough liquidity. The below analysis examines death benefit for a preferred plus male at forty, fifty and sixty years old, which comes from our previous analysis of VUL.

The second way to maximize the cash value is ensure you only access it for once-in-a-lifetime opportunities. Since the loan against the cash value is not subject to income tax—unlike 401(k)s, IRAs, or traditional brokerage accounts—it is an effective vehicle for creating supplemental income during retirement. According to a new report from Northwestern Mutual, Americans now believe they need $1.46 million to retire comfortably, yet Gen X, the alpha tester for the 401(k) retirement system, is reporting gloomy results pertaining to its effectiveness. According to the newly released Goldman Sachs Retirement Survey, nearly half of Gen Xers say their retirement savings are behind schedule, having saved only an average of $109,600. With Social Security benefits set to decline 24% by 2033 without policy revisions, along with increasing longevity risk and healthcare costs, the level of financial support needed to retire comfortably is increasing.

The third way to maximize the value you get as a policyholder with cash value life insurance is to align with the rest of your financial portfolio. Whole Life is beneficial if you want diversification away from the market and guarantees, with a tradeoff of lower potential growth. Whereas UL policies allow you to earn cash value based on the market’s performance in different manners.

If you do access the cash value early, a good rule of thumb is that the cash flow from your investment should pay back your policy loan and it should all be done on a regular schedule. However, before making any of these kinds of decisions, our Optifino experts can help you understand the time horizons and considerations that go into when you want to access the cash value—both during the policy design process and as a part of our ongoing aftercare.